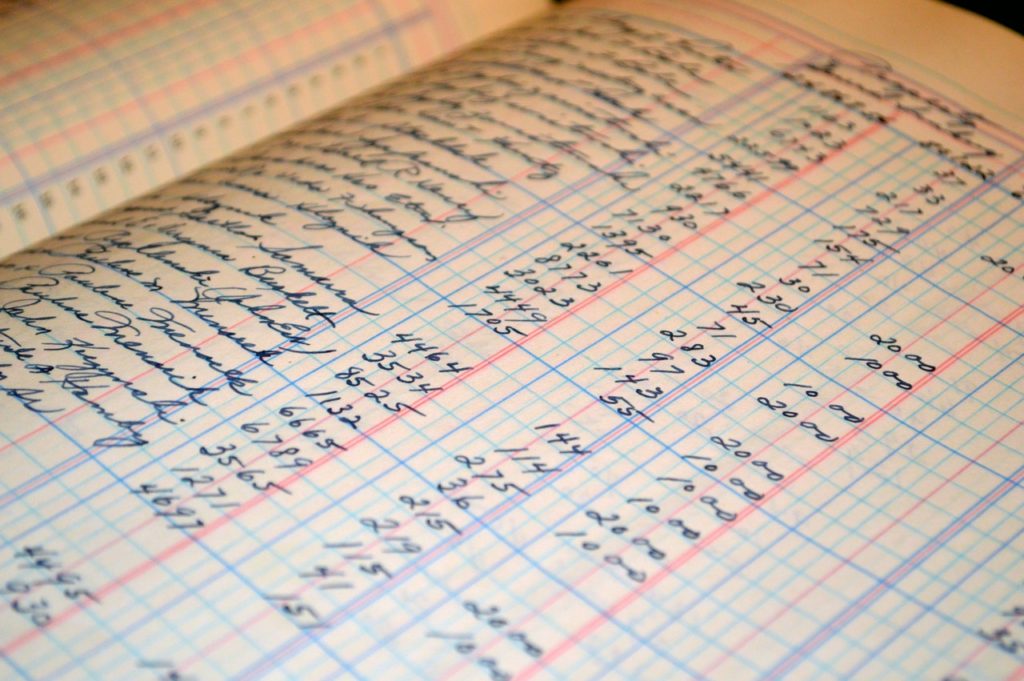

Making bookkeeping mistakes can lead to misleading financial figures, bouncing checks, and collecting from customers that already paid. These errors can lead to problems with your cash flow because you have yet to update and reconcile your accounting books. Regular bank reconciliation has many advantages that allow your small business to manage its resources effectively.

Here are some of the benefits of balance sheet reconciliation you should look into.

Identify Errors Immediately

One of the advantages of updated balance sheets is that it allows you to identify mistakes in your books immediately. Overlooking accounting errors has a cascading effect on your financial standing. You might believe your small business’ costs are low and profits are high even if they are not. You might also miss collections because of mistakes in your books. Regular balance sheet reconciliation allows you to identify these errors immediately and keep your financial records updated.

Reconciliation Updates Possible Changes in Fees and Interest

Your bank, suppliers, or other creditors may add fees, interest, or penalties to your account. If you don’t reflect these on your statements, your financial data will not accurately depict your position and options. The additional costs reduce your potential profit and cash flow to other parts of your growing small business. Regular bank reconciliation allows you to avoid these headaches. With regular bank reconciliation, you’ll have updated financial information in your accounting books. You can use the updated information to find ways to reduce costs and boost profit.

Helps Determine Fraud

One of the benefits of bank reconciliation is that it allows you to identify and prevent fraud. A disgruntled employee might steal money from your small business through fraudulent accounts and transactions. You might be unable to catch their initial act, but you can identify patterns of theft with regular bank reconciliation. Bank reconciliation allows you to trace and monitor transactions in your ledger.

Simplify Monitoring of Receivables

A receivable may not reflect in your financial statements right away because a customer may pay for them at a later date. Bank reconciliation saves you from the embarrassment of calling a customer about their dues when they have already paid them. Bank reconciliation makes it easier for you to track receivables.

Track Monthly Transactions

You’ll need a general idea about the transactions you’ve made to make sure your cash flow is good. Uncashed checks can make you think you have more cash than you actually do. This has a negative effect on your operations because you might not have enough resources to cover expenses or go through with a planned expansion or invest in product development.

Manage Finances Effectively

Balance sheet reconciliation allows you to manage your resources and allocate them effectively. You’ll know which aspects of your operations need extra financing and when you need to follow up on a receivable. Updated accounting books are your source of information whenever you decide about the direction and strategies of your small business.

Reconciling your balance sheets is clearly beneficial for your small business. Make it a habit to do so, so that you can manage your growing company’s finances effectively. We at Robookkeeper can be your outsourced bookkeeping partner. We provide you with experience and expertise in bank reconciliation. We offer first-rate bookkeeping services for small business owners.